IAIC Market Update - June 7, 2021

Last Week in the Markets: May 31st - June 4th, 2021

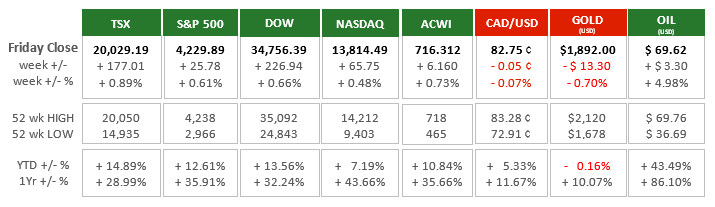

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened last week?

- Canadian and global equities enjoyed another week of positive gains. For the second consecutive week the TSX was the best performing index gaining nearly 1%. The TSX also maintains its first-place position in Year-to-Date increases for 2021.

- This performance persisted despite the 68,000 job losses in Canada in May that pushed the unemployment rate to 8.2%. Conversely, the U.S. added 559,000 jobs during the same period, which was below the consensus expectation of 670,000 jobs.

- In both countries the staging and scale of reopening weighed heavily on employment and jobs numbers. As Canada reopens jobs are expected to be added in large numbers during the second half of the year. In the U.S. May’s new job creation was double the number of April as the post-pandemic economic recovery continues.

- As of the end of May, Canada has 700,000 fewer jobs than pre-pandemic levels while the U.S. has nearly 8 million less jobs. There is significant opportunity to add jobs as each economy recovers. The level of unemployment will likely result in new jobs, not higher wages, as expansion occurs. This should help delay inflation, which would spur central bank action to increase interest rates.

What’s ahead for this week?

- In Canada, the most significant economic announcement for the upcoming week will be the Bank of Canada’s latest monetary policy announcement on Wednesday.

- In the U.S., inflation figures through the Consumer Price Index (CPI) for May are scheduled to be released. Wholesale inventories, Q1 flow of funds and May’s budget balance will also be announced during a relatively light week for domestic economic news.

- Globally, China will announce its trade surplus, money supply and foreign reserves. Japan and the Eurozone will deliver real GDP numbers. The European Central Bank will hold a policy meeting to analyze their economic indicators and global trend to influence upcoming monetary policy statements. On Friday the Group of Severn (G7) countries will hold a summit meeting.

For more information contact:

Independent Accountants’ Investment Counsel Inc.

135 Main St. E. Listowel, ON

Phone: 519-291-2817 or TF: 1-877-291-3040

icpmss@iaic.ca

This report is produced by Independent Accountants' Investment Counsel Inc (“IAIC”) in conjunction with ARG Inc. All graph and chart statistical data contained in this report has been supplied by ARG Inc. The views and opinions expressed in this report are based on market statistics. No guarantee of outcome is implied and opinions may change without notice. Investors should not base any of their investment decisions solely on this report nor should any opinions expressed within this report be construed as a solicitation or offer to buy or sell any securities mentioned herein. Although the information contained in this report has been obtained from sources that IAIC believes to be reliable, we do not guarantee its accuracy, and as such, the information may be incomplete or condensed. All opinions, estimates and other information included in this report constitute our judgment as of the date hereof and are subject to change without notice.

Please contact your IAIC representative if you have any questions regarding this report. ©Copyright 2021 Independent Accountants’ Investment Counsel Inc. All rights reserved.